Lastest Post

Since 2008 pundits such as Nicolas Nassim Taleb and Peter Schiff have been calling for the end of the bond bull and they keep being wrong. The DJIA is up 20% in the past two years, but even more astonishing is that TLT, a 'risk-off' ETF is up 25% in that same period.

This disproves the often repeated leftist canard that a bull market in stocks and bonds are mutually exclusive due to some 'great rotation'. Dyseconomcis, on the other hand, predicts a huge bull market in ALL asset classes, including bonds, stocks, gas prices, commodities, treasuries, munis, and junk bonds. The smallest hiccup in Europe sends yeilds plunging while stocks only fall a tiny amount or stocks will surge like they did on Friday but yeilds don't budge. Merkel farts and it instantly becomes a 'risk off' event according to the bond market & US dollar. Corperate America will keep refinancing their debt at lower and lower rates and use the proceeds to repurchase stocks.

Liberals in various media outlets such as CNN, MSNBC, and New York Times over-hyped the otherwise contained subprime crisis into a full fledged financial crisis to get Obama elected. Now they are spreading lies about the debt being unsustainable or how we need more stimulus spending when, in fact , the economy is booming. They want America to pay higher interest on its debt or to waste money on useless job creation, infrastructure and entitlement programs. Liberals want America to be ashamed of its exceptionalism and meritocracy, while spreading lies about inequality being bad for the economy to force a populist, wealth spreading agenda. Liberals seek economic crisis as a way to mold society to their liking, like during the Great Depression when FDR tried to pack the Supreme Court with six extra pro-New Deal justices. They amplify any shred of bad news such a Cyprus into a paradigm changing crisis. http://tiny.cc/szjcuw

Pretend conservatives seek fiscal restraint to soak the rich in contrast to democrats that want tax hikes, but either way the outcome is the same which is wealth destruction targeted on 1% who are the most adversely affected by excess regulation, taxes and fiscal restraint. Liberals like Schiff want the fed to prematurely raise rates and he's spreading lies about the debt being unsustainable despite the fact that long term yields are still near historic lows even with this huge bull market.

3/22/2013 Restoring Growth and Optimism to the GOP

Stocks are surging today because the economy is still fundamentally sound. No one on Wall St. cares about Cyprus, debt, job loss and stuff like that. Dow 15000 just around the corner. Bitcoin is goin to $200 soon. People getting richer than ever through speculation, web 2.0, housing market.

Since around 2008/2009 the GOP has been infected with a pervasive strain of pessimism or what I call 'small government liberalism'. This is a GOP that eschews its pro-growth successors of George W. Bush and Reagan for small government, fiscal frugality, financial regulation, and protectionism. These are the conservatives that oppose the drone program and deficit spending while attacking Wall St. and fanning the flames of class warfare for populist votes. The GOP , once the party of boundless optimism- harbingers of a 21st century manifest destiny to spread technology, democracy and free markets to all corners of world has withered into a shell of small government small minded irrational fear; fear of financial instruments, fear of globalization, fear of technology, fear of deficits.

There is a large disaffected electorate that has been hurt by the overblown, media generated financial crisis (exacerbated by the New York Times to get Obama elected) and stock market plunge, but that doesn't mean the GOP has to renounce the policies that worked spectacularly well during strong economic times- mainly pro-growth, free trade, monetarism, and interventionism. The rise of Rand Paul or 'small government liberalism' is endemic of this problem. Attacking 'fat cats' and the military industrial complex is a cathartic approach that appeals to voters, but the GOP must resist the temptation to co-opt these platitudes that are the mainstay of welfare liberalism.

There is a tendency for this new GOP to spread misinformation about the deficit and the economy. They want America to get its 'fiscal house' in order, but is this just another example of making a mountain out of a fiscal molehill? For example, these 'small goverment liberals' conviently ignore the fact that the USA pays less interest on its debt relative to GDP than in the 90's. Deficits can be used for good and bad; in the case of Paul Krugman and other neo-Keynesians they are used to force equality and job creation, and at a large waste. Conservatives, on the other hand, skillfully used deficits in the 80's and 2000's to promote pro-growth policy such as defense spending and tax cuts. See, the problem isn't the deficit or the size of the government, but how it is used- a subtlety that 'small government liberals' fail to grasp. Thanks to 'big government' homeland security programs, over fifty homegrown terror plots have been thwarted since 9/11. Conservatives in siding with the UN would rather have the USA abort the war on terror or risk lives of more US troops to kill terrorists How many US citizens have been killed by drones? Exactly one, who happened to be a terrorist mastermind (which I think is grounds for revocation of citizenship). Other conservatives such as Peter Schiff frequently compare America to Greece, ignoring that Greece pays considerably higher interest on its debt than the USA and is an economic weakling with a GDP smaller than Boston.

Deficits, bank bailouts, and drones aren't the problem; the problem is liberalism and a recessionary woe is me attitude that has permeated the modern conservative movement. We need less Burke, Kirk, Will and Buckley and more Kristol, Krauthammer, Milton Friedman, McCain and dare I say Rush Limbaugh? http://tiny.cc/0liutw I implore the GOP to stop the anti-debt, class warfare rhetoric and bring back pro-growth policies.

3/20/2013- Dow 500,000 and the Interest Rate Cycle

According the the interest rate cycle, we can anticipate a bull market on a grand scale- the longest and biggest bull market in the history of the stock market.

Before we delve into a more detailed explanation of the interest rate cycle, here are some of the bullish economic/fundamental factors that are driving stock prices higher:

1. Endless liquidity from QE, institutions, 'flight to safety' , and foreign surpluses. (When the USA runs a trade deficit its trading partner has a surplus that can be used to buy treasuries and that helps depress interest rates)

2. Persistently low valuations. Despite a 135% rally from the March 2009 lows, the PE ratio for the S&P 500 is still just 14.

3. As a consequence of the BRIC boom there's billions of potential customers and demand to compensate for any consumer weakness in America. As much as 46.3% of the revenues in the S&P 500 originate abroad.

4. Increase in buybacks & mergers.

5. A constant backdrop of negativity that keeps the masses out of equities, preventing prices from rising too quickly. This negativity also helps keeps rates low due to the flight to safety/US dollar safe haven phenomenon.

6. A bad news=good news phenomenon. This is where bad news is construed as being bullish because it increases the odds of more easing (the Bernanke put).

7. Rapid development of technologies to increase worker productivity and economic growth.

8. Falling personal savings rate directly helps retailers.

9. Positive yield curve

10. Improving housing market

11. Corporate balance sheets showing record high profits.

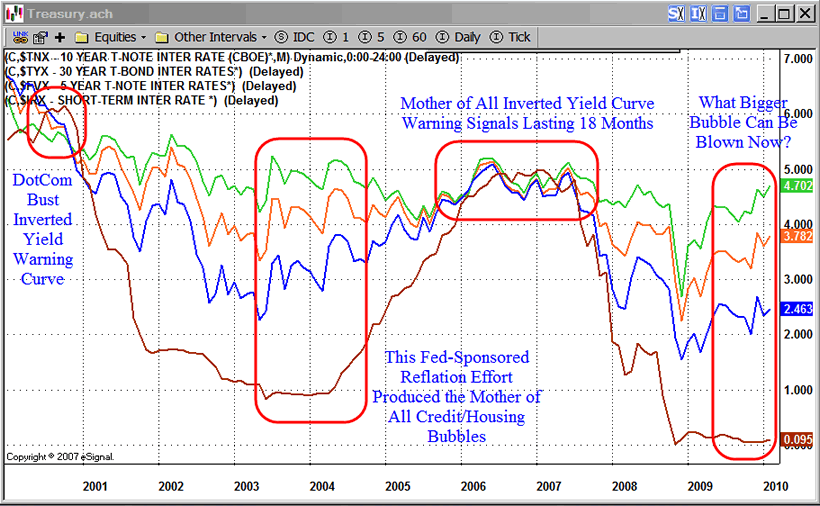

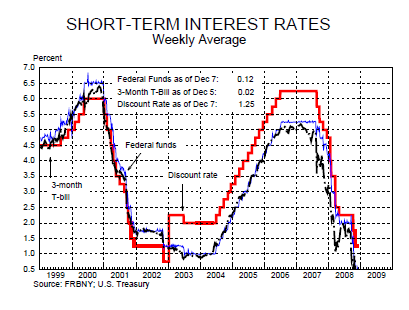

As we all know short term rates are still at zero, as they have been since 2008. Our prediction is that it may be five years or longer before the future fed chief finally raises rates with the consensus is that this will be a bearish event for the market. We take a contrarian view that rate hikes will not have a bearish outcome because the fed will give abundant warning and will raise them in such a way that he will be 'behind the curve'. Rate hikes are bearish when the are unexpected; nowadays unlike in the 70's and 80's the fed gives ample warning as to not spook the market. Stocks will keep rising until the short term interest rate cycle peaks at around 5.5-6.5%, like in 2000 and 2007. Presently they are still at zero so we can extrapolate that with the DJIA already at 14550 the market has substantially higher to go. At the peak of the cycle the interest rate curve becomes inverted, a hallmark of bearishness.

We're still far away from an inverted yield curve

Stocks peaked in 2000 & 2007 as interest rates exceeded 5% and the yield curve turned flat or negative.

But what about that fed balance sheet? What if it gets out of control? There is a misconception that the fed balance sheet is a ticking timebomb waiting to explode at the first hint of inflation or that it's rapidly increasing. But believe it or not, the fed's balance sheet has only increased some 250% since 2008 with the majority of the gains between 2008/09. Since 2010, it only increased gradually, and furthermore the fed balance sheet doubled between 1995 and 2005 and the world didn't come to an end. Maybe I'm wrong, but I would rather make money now than sweat the hypothetical doom and gloom that may never happen. Secondly, US federal government interest payments as a share of GDP is still at near historic lows.

In fact, we can't even put an upper limit on the DJIA because we haven't even had our first rate hike but assuming the fed raises rates to .25 at dow 20,000 some simple algebra gives a target of around Dow 500,000 at the peak of the cycle. Assuming an aggressive annual return of 15% this will occur about 24 years AFTER the first rate hike. This will be a very big bull market, indeed.

3/20/2013

Typically when the market is flat or falling there are fewer posts or otherwise there would be no time to work on other stuff. Here's the summary of events:

Cypus: ignore it and buy the dip. no brainer.

That's pretty much the only substancial economic event since the last post and it can be safely ignored. We're going to dow 15000 soon, like it or not. These liberals will be dragged along for the ride, kicking and screaming. They want to see the consumer fail, the bond market collapse, for the fed to prematurely raise rates, for American worker to be less productive. The liberals are asking 'where's the recovery?'. The answer: it's already here. Stocks are surging, profits for S&P 500 companies keeps being blowout, and economic data sill better than expected. Thanks to rapid growth in exports and business-2-business based commerce, we don't need mainstreet's partiticpation to have a booming economy. Companies like Google, Intel, Cisco and IBM, for example, are mainly B2B. A small percentage of S&P 500 companies sell exclusively to the US consumer. Disney, McDonalds, and Starbucks are global large cap consumer brands. On the other hand, companies like Netflix and Lululemon are midcap companies with the US consumer as the predominant customer.

3/14/2013 A forever rising stock market?

Is it possible that the stock market may never have a meaningful correction ever again?

Here are four theoretical paths the stock market could take.

The most likely outcome is either the red or blue path, which are the most smooth. Why is smoothness so important? Because we propose a scenario for the next 20 years and beyond where the stock market perpetually rises and the indexes become less volatile and well-calibrated as funds intercede to smooth out any price perturbations. The trading volume will keep falling and this makes it easier to prop up the price in the event of selling, and hence there will be less volatility. In the event of selling the funds will immediately buy the dip and with a few days the market will be higher, yet again. The volume/price symmetry is a solution to the chart to scalar equlibrium equations and partially explains why the market is so quick to recover from its selloffs, the other explanations being strong economic fundamentals and forever low rates.

The volume/price symmetry as predicted by chart to scalar theory as illustrated in this crude diagram agreees with patterns observed in real stock charts.

As the price falls at a greater rate, the volume rises. The volume remains elevated on the way back up, forming a symmetrical path reflective about the nadir.

We predict that it may be five years or longer before the future fed chief finally raises rates and at that stage the fed will be so far 'behind the curve' that Wall St. won't care because the fed's intent will have been telegraphed long in advance. Interest rate hikes are bearish when the are unexpected; nowadays unlike in the 70's and 80's the fed likes to give lots of warnings as to not spook the market. Stocks will keep rising until the interest rate cycle peaks at around 5.5-6.5%, which is how high interest rates were when the market peaked in 2000 and 2007; presently they are still at zero so we can extrapolate that with the dow already at 14520 the market has substantially higher to go. In fact, we can't even put an upper limit on the price because we haven't even had our first rate hike but assuming the fed raises rates to .25 at dow 20000 some simple algebra yeilds a a target of around 480,000 at the peak of the cycle. Assuming an aggressive annual return of 15% this will take about 24 years AFTER the first rate hike.

3/13/2013 The daily view: Consumers, Apple, Nicholas Nassim Taleb, Fake Conservatives

Anyone that has read this blog would know that the liberals have been front-running the demise of the consumer since 2009 and they keep being wrong. Consumer spending yet again crushed estimates, in retrospect making the huge rally since 2012 fundamentally justified rather than just feeding off fed intervention.

This is a large cap, multinational, web 2.0, retail, cloud computing, payment processing, search engine driven economic boom. Small business is still for chumps due to obscenely high borrowing costs, no assistance from the govt. or fed , and cutthroat competition.

There are two misconceptions about the etiology Apple's decline: the absence of Jobs and a lack of innovation. I'll refute both.

Bunsinessinsider writes "Without Jobs, there is no one at Apple with the charisma to beat back the stories about Samsung's rise and Apple's fall. There is no one to explain what's happening with the iPhone business. There is no one to artfully drop hints about future products and massacre the products of rivals."

Even if Jobs were alive it wouldn't matter. When Steve Jobs died AAPL was only at $375 and no one was complaining about Mr. Cook as it rose another 300 points. The problem is all the enthusiasm for Apple has evaporated isn't going to return anytime soon. Apple needs to make a major acquisition. Maybe buy LNKD, Ebay or Twitter to get investors excited again. It is a misconception that Apple doesn't innovate enough. The argument can be re-framed another way: Apple has actually done more evolving than the majority of tech companies. They have released dozens of variants of iphones, ipads, macbooks, ipods, etc. What has Ebay done differently since 2002 when it acquired Paypal? Nothing and yet Ebay stock is at a historic highs. Apple's problem is that they are forced to keep developing new products to be relevant and if they miss a beat the stock & earnings will get murdered as is happening now. But the second problem is the mass realization that the first problem exists, compounding the problem.

Closeted liberals like Bruce Krasting and Peter Schiff are fanning the flames of crisis by spreading misinformation about inflation.

Bruce Krasting writes this "When will S&P say 'enough-is-enough', and drop the US credit rating another notch? Given that there is no leadership at all, the folks at S&P must be thinking about how to respond. Last time it did not matter a damn that the rating was dropped. I donít think the country will be so lucky the second time around."

If Bruce were a real conservative he would credit the historically low yields to the ingenuity of the free market and this would be desirable instead of appealing to the rating agencies to issue unduly punishment on the economy & bond market for something he doesn't agree with. Unless he can have his way, Bruce would rather have the economy & stock market suffer due to inflation, which is a very self-centered way of looking at the world.

We need wealth creation and not wealth spreading. America is a beacon of economic growth and prosperity in a world of excess regulation, corruption, and populism. However, we shouldn't get bogged down in the minutia of budgets because according to the bond market the last thing we should be worrying about is deficits. We need more pro-growth spending on tax cuts and defense. Yields are actually lower than before the downgrade despite the stock market being up 20% since then. The rating agencies have been defamed and yet liberals like Bruce Krasting, Nicholas Nassim Taleb, and Peter Schiff keep spouting this fiscal frugality nonsense. Nicholas Nassim Taleb recently published a 500 page book called anti-fragile that does a better job as a doorstop or cinder block than revealing the subtle complexities the world or providing actionable advice. Like most libs he loves to complain about rich people being oblivious to risks or being overcompensated. He wants a nanny government to protect people from the imaginary risks to the detriment of the economy and free market.

he's crazy

3/11/2013 Being Right All the Time is a Thankless Job

Some people don't like the links I post. I consider it to be a small reward for sharing free information that has made people thousands or maybe millions by not selling too soon in this huge bull market. I feel entitled to post links in exchange for sharing this information out of my own generosity.

Here is what is really stupid: I get thumbs down for being bullish in Apple in 2011/2012 and then thumbs down for being bearish in 2012/2013? Maybe it's the liberal mentality of attacking success and pitying the underdog, even if that includes a $400 billion dollar company. There are some things that are so stupid you can't describe it in words, you simply have to behold it.

American exceptionism is how US companies can amass such big profits and hire so little. The most common excuse is uncertainty over imaginary geo political risks and yet these companies keep posting blowout profits & earnings quarter after quarter for like 4 years in a row. Maybe by risk they mean the sun burning out or something like that. There are no hidden risks; it's just an easy excuse to not hire. So be it. America is #1 in terms of stocks always going up, enriching speculators, and minting overnight internet billionaires, but job creation? Err...not so much. Tough shit, loser. Better learn how to code cuz that's how ppl are getting rich these days. Or if you can't code, open an etrade account and buy as much Google stock as possible.

Everyday these crisis-seeking liberals on sites like businessinsider, NYtimes, Washingtonpost or Zerohedge try to scare you into selling too soon by spreading FUD about impending profit margin contractions, the non-existent crisis in Europe, about how wealth inequality is a threat capitalism, or the media generated US debt crisis. Let's just assume that in the not so distant future the debt become so big that everyone is convinced that it poses a real threat to the economy. What will happen? Ironically, yields will fall as everyone gets scared, hence the the debt becomes less burdensome. And that will solve our earlier problem, so the fear over the debt becomes a self-defeating prophecy.

We're still in the greatest prosperity boom in the history of human civilization. When will the fed raise rates? How about never? Assuming hell freezes over and Bernanke ends QE what will happen? The widely held and incorrect belief is that stocks will fall, but the actual data shows that stocks can indeed rally as the fed tightens, iF the fed is perceived as being behind the curve. That's why stocks surged even as Greenspan raised rates in the 2000's.

Go ahead and read the article archives where I astutely predict the sequester and fiscal cliff would have no negative impact on stocks. Read Dyseconomics written in 2011 that predicted everything that is happening today such as the massive stock rally.

3/8/2013 Playing the 'catch up' game for quick profits.

The biggest risk to the recovery is if too many people participate in it. We need bigger profits, fewer jobs, more consumer spending, stingier credit for homeowners and small businesses, we need lower borrowing costs for multinationals, more consumer credit, and more productivity. We need more people clicking google ads and putting resumes on linkedin. The liberals are still waiting for the shoe that will never drop as the market keeps climbing higher day after day, week after week..

Dyseconomics predicts broad multi-asset class inflation driven by abundant global liquidity. Since around 2002 asset classes that traditionally has small or negative correlation such as stocks, hard commodities, oil, grains, gas prices, junk bonds, treasuries, munis, will rally together with a relatively high degree of correlation.

Sometimes an asset class will lag, but then with the slightest provocation it will shoot higher and 'catch up' with the S&P 500 -the ringleader of this liquidity driven asset boom. Back in May 2012 oil fell from 108 to 78 while the broader index fell only modestly. A five months later oil would retest 100 again, a gain of over 20% in just a few weeks as the major indexes made new highs. Now the DJIA is at 14350 but WTI oil is still stuck in in the low 90's , providing an opportunity to buy oil as a 'catch up' play. Same for wheat and gold which have also lagged the S&P. I predict that within the upcoming 6 months for reasons ever so subtle (ie a abnormally hot weather), grains, oil and gas prices will rocket to new highs, or enough to match the S&P 500 in YTD performance. So if the S&P 500 hits 1560 we could see a 20% rally or more in oil, wheat and corn. I am especially confidence about this prediction because Bernanke has given zero indications of ever raising raising rates again despite 130% gains in the major indexes and doubling of profits & earnings for S&P 500. This is unprecedented in the history of macroeconomics for there to be a profits & stock market boom of this magnitude without accompanying interest rates hikes. Or for unemployment to remain perpetually high despite major profit windfalls. To be honest, Bernanke doesn't give two bits about the unemployed and neither does Wall St. but a bad labor market makes a great excuse to never raise interest rates again. And that is part of what is contributing to this massive asset boom, the other being robust global growth and the third being inelastic arbitrage. So don't fight the fed. Buy Google, LinkedIn, Amazon, and UGA gas ETF. Buy the S&P 500 and DJIA. Buy IBM, FB, CRM.

3/5/2013 Ignore the liberal fear machine

My goal is to present an alternative reality in the most blunt way possible, to shake up your prexisting notions of how things. I want my writing to be a kick in the ass to anyone that gazes upon it. When you read your first repsonce is probably 'is he serious?' and the answer is always 'yes'. Everyday we're bombarded with news, opinions, headlines, and other cutter. Liberals experts such as Roubini and Nicholas Nassim Taleb are telling us to be mindful of 'imaginary risks' and to sell your stocks and bonds, when people such as myself who present an empirically centric view of the world get virtually no coverage, yet keep being right over and over. Making matters worse the importance of stories tends to be inversely proportional to the coverage, so a small $85 billion sequestor cut will have more longevity and intensity than a story about the personal savings rate falling, even though the later is more important in terms of economic impact. They shower us with contradictory headlines written in big bold font with lots of superlatives and exclamation points because this is REALLY FUCKING UGRENT and EVERYONE agrees that THIS WILL HAPPEN!!

In the past two years I've written enough blog entries and essays to fill a 300 page book and created an entire option pricing and stock market 'theory' from scratch, just because. It isn't good enough that stocks are going up I wanted to know why and when the existing explanations were scattered and inadequate, so I set out to write my own. Oh and then there's facebook work and all the links. So it has been a pretty busy past few years and we're not stopping yet. Just get to keep pushing ahead.

3/5/2013 2 Years Later

This stock market is unstoppable. Everything keep being better than expected and all bad news is either unimportant or priced in.

In two years we've come a long way. In 2011 we developed a new economic theory called Dyseconomics or dystopian economics (the economic system of a dystopian society). Dyseconomics takes the conventional rules of macroeconomics and rewrites them in such a way that it fits with empirical post-2008 observational data. The Dyseconomics interpretation of macroeconomics has proven to be the most accurate one yet, more so than Keynesian, Austrian, mixed, etc . Paul Krugman, a saltwater Keynesian is right about Bernanke and the need for more spending, but in the context of Dyseconomics is wrong about how the money should be spent or the importance of full employment. Adherents to Dyseconomics may not agree or like the values it espouses, but believe it's the most accurate way of looking at the world, hence necessitating a cognitive dissidence. Most people can't make this leap and only choose to believe what makes them comfortable, not what is true.

We believe an economic system where the masses reap a disproportionately small amount of the aggregate wealth, is either optimal for growth or a byproduct of a economy functioning optimally. Most economics agree with this observation, but efforts by activist economics like Krugman or Joseph Stiglitz to try to make society more equitable in repudiation of this trend, are destined to fail. In contrast to a participatory democracy that is contingent on individuals participating in the democratic process, an economic system should be exclusionary and autonomous with only occasional intervention by elite policy makers in crisis.

Back to Paul Krugman. He is wrong about austerity, inequality, and employment. We need more of the first two and less of the later. Paul krugman keeps spreading the lie that austerity is bad for the economy when, in fact, case studies such as Italy, Greece, and Spain have shown it to be beneficial, resulting in lower yields, faster growth, and improved sentiment. Austerity should be imposed on mainstreet, but expenditures for tax cuts for the highest of income earners, homeland security, and defense should be unchanged. As written in the 3/4/2013 article, the rich do a better job spending than everyone else. They also create jobs and technology in contrast to the lowest of income earners that use their income for subsistence.

We don't need job creation programs or student loan relief; instead we need continual reassurance that Bernanke will not end QE and that Washington will not acquiesce to the wealth spreaders that want to make America unsafe.

3/4/2013 The US Consumer, Still the Best in the World

Part of what makes America a crappy place (such as surging living expenses, nosebleed healthcare costs, inflation lagging wages, evaportating social safety net, and record wealth disparity) also ironically makes its economy and stock markets superior to the rest of the world. I recommend living abroad while investing in America in contrast to living in America and investing abroad. Since 2009 the S&P 500 and DJIA has handily outperformed every major stock index. Remember the unfounded comparisons between the US and Japan that were repeated ad nauseum back in 2009? With the excpetion of the Nasdaq, every major US index is within a few percent of historic highs versus the N225 which is still 75% from its highs. In retrospect, America is becoming more like America and Japan..well..more like Japan. The great moderation that began in 1982 shows no signs of ending. The calm before the storm is the calm before more calm and Dow 15000. America's youthful demogrpahics, free market capitalism, proactive central bank, and propensity for consumption is unique amoung other developed economies. We're going to have 7.5-8% unemploymenr for many more years to come, giving Bernanke and his successor an excuse to never raise rates again, but more importantly foreign surpluses and flight to safety are helping keep interest rates low.

People keep getting this wrong; there doesn't have to be a great rotation out of bonds and other fixed income for stocks to keep surging. There is enough liquidity for everything to go up.

From the WSJ: "Taxes are up. Incomes are down. Gas prices are rising. Tax refunds have been delayed. Yet consumers, so far, appear unfazed."

None of those things are a big deal, as I predicted in 2011/2012. The spending is coming from somewhere; overseas consumption, the wealthy, falling personal savings rate, more debt.

From the WSJ: "As taxes rise, prices climb and incomes fall, it's the wealthiest U.S. households that are driving spending. Meanwhile, middle-class and poorer households are feeling the economic brunt. "

This is good for the economy or a sign that the economy is functioning properly. That's why we need to raise taxes on the <$200k/year bracket and lower them for the rich because they do a better job spending money in an economically efficacious manner. The top 20% of earners account for about 38% of all spending, according to Labor Department data, nearly as much as the bottom three-fifths of earners combined.

Are speculators driving up prices? Probably, but does it matter? Specualation is double edged sword and the liberals conveniently forget that the same speclators that drove up oil prices in first half of 2008 drove them back down at a faster rate in the second half.

Another reason for surging commodities, healthcare, insurance, and gas prices could be due to inelastic arbitrage. When a price change has no effect on the supply and demand of a good or service, it is considered perfectly inelastic. For much of the 80's and 90's there was a gap between how much Americans would be willing to spend on inalastic gods like gas and the actual price of gas. Now there is a 'mass discovery' of the existance of such a gap, which is being arbitraged away by inflation exceeding rising prices.

From the WSJ: "Behind that seeming paradox lies a consumer sector that is increasingly split in two: Wealthier households, buoyed by improving home values and a rising stock market, are spending more. Poorer ones, hammered by higher taxes and rising gas prices, are holding back."

They are not holding back. Look at the data that shows that the personal savings rate is falling. The US savings rate fell from 6.4 percent to 2.4 percent in January.

Exactly as I predicted would happen: Personal saving rate falls

"People in the top half of the income distribution are doing just fine. They're spending enough to keep the economy moving," said Mark Zandi, chief economist at Moody's Analytics. "But the lower half is having a difficult time keeping their heads above water."

I wrote about the bifurcated economy in Dyseconomics and subsequent articles. We don't need mainstreet's participation to have a strong economy; however consumer speding is still robust so even if mainstreet is feeling strained they are not slowing consumption whatsoever.

Some person nammed 'chumbucket' wrote that some of the consumer data was weak. My response is to look at the stock prices an PE ratios, and not to get bogged down by the minutiae of the individual economic reports, which tend to be volatile, contradictory, and unimportant. Walmart has surged $4 since the libs were certain that the errant email sealed its doom. I guess the end of the consumer will have to be put on hold, yet again. The PE ratio of the S&P 500 is still just 13.

Google is going to $1000. AMZN $400 again like Blodget predicted in 1998. 15 years later he'll take much derseved credit for this call.

Government is both the solution when they bailout too big to fail and the problem when they over regulate.

As a consequence of the sequester I hope student loan rates go up. That will give prospective students an incentive to choose higher paying careers and perhaps study harder, too. The student loan debt, however, is not a bubble and does not threaten the economy whatsoever.

2/28/2013 Why ZeroHedge Sucks

ZeroHedge (ZH) is anti-reality, anti-facts, and pro-wealth destruction. On Monday the carrot of crisis was dangled before Zerohedge's readers, only to be yanked away in this huge rebound that has propelled the indexes to new highs.

The ethos of ZH is to blame the fed, Washington, Wall St., and the rich for all the ills of the world, which is similar to liberal sites like NY Times and Huffingtonpost, but with a more libertarian bent. Real republicans want wealth to be created instead of destroyed and don't read ZH.

The world isn't coming to an end. There is no bond or stock market bubble. There is no eminent hyperinflation. No hidden risks. High frequency trading isn't a ticking timebomb. America isn't Greece. We have the best consumers, best stock market, and economy in the world. America is second to none in innovation, wealth creation, free market capitalism, and stocks always going up. Zerohedge wants America to feel ashamed of its exceptiomism, for our troops to withdraw in defeat, for the fed to prematurely raise rates and I say, 'no, no, and no!'.

Goldman, AIG, bank of America, and AIG have the most pristine ballance sheets in years. Let's give a round of applause to the speaker Boehner, the GOP congress, and Bernanke for navigating these difficult political waters in the face of constant criticism. When so many anticipated failure, they rose to the occasion, creating trillions of dollars of wealth.

This market always goes up and I keep being right about everything. When I say something isn't a big deal, it usually isn't. I have an uncanny ability to filter out minutia from the constant bombardment of news and data. This market in unstoppable due to tame inflation, no deflation, and robust fundamentals, and I guarantee that in the upcoming months the economic & earnings data will affirm this.

The graph below shows two possible RHS (right hand side) paths for a hypothetical stock upon encountering a LHS (left hand side) resistance force. Chart to scalar uses variational methods and functional analysis to simulate how stocks trade when encountering obstacles or resistance or support forces, that are represented by simple shapes.

2/27/2013 The Daily View: Ignore the Sequester and Italy

>> Dow 14100. Phase two begins.<<

I don't need five hundred words to tell you that any dip caused by Europe based fears is worth buying. The economic impact of the Italy election is ignorable and doesn't affect the fundamentals any of the S&P 500 components. Go back as far as the 80's and everytime the US markets have sold off on foreign uncertainty it has always rapidly recovered. Same for the upcoming sequester- another non-event, or the fiscal cliff (which I correctly predicted in 2012 to be a speedbump and a buying opportunity). Typically, the economic impact of news is inversely proportional to the coverage. In just the past week alone, Huffingtonpost has published over a thousand stories about the sequester.

See for yourself https://www.google.com/#q=site:huffingtonpost.com +sequester&hl=en&safe=off&tbs=qdr:w&psj=1&ei=DE8uUaSUHeOQi ALZvYDABg&start=10&sa=N&bav=on.2,or.r_gc.r_pw.r_qf.&bvm=bv.429 65579,d.cGE&fp=7a4cdc557dea5c34&biw=1366&bih=667

That is just the Huffingtonpost so you can extrapolate the total number of sequester stories from all media sources over the past month is probably in the hundreds of thousands.

What will happen after the sequester rolls along? Not much. The left, waiting in eager anticipation for the cuts to hurt the stock market, will be dissapointed yet again as Wall St. blows it off just like after the cliff in Jan. 2013. America is coming a nation of liberal crybabies seeking crisis and recession , and I refuse to participate.

Chart to Scalar option pricing has been modified for bifurcated support/resistance triangles

http://en.wikipedia.org/wiki/User:Stockequation/sandbox#Pricing_Options

2/25/2013 Wealth inequality: Much ado about nothing

Here we go again. Stocks keep surging and it's time for another post.

The myth that wealth inequality is bad for economy is perpetuated either out of ignorance or by liberals trying to promote a subversive wealth spreading agenda. Anti-wealth disparity sentiment is commonplace on a variety of news sites such as Zerohedge, Washingtonpost, Businessinsider, New York times, and Huffintgtonpost where the fed, republicans, congress and the rich are used as a scapegoat for a myriad of supposed societal ills.

Wealth inequality should be embraced, not scorned because it is a byproduct of a free-market economy that rewards innovation by its creators. That's why as a debt reduction compromise we need to raise income taxes under the $200k/year bracket, eliminate the earned income tax credit, and lower taxes for the highest of income earners because the rich contribute better to the economy than everyone else in terms of consumption, job creation, and innovation. What about people falling between the cracks? What about stagnant wages or the loss of opportunity? No where is it written in stone that a rising economic tide is supposed to lift all boats or that downward economic mobility isn't contemptible with a robust economy. There is no statically significant evidence that shows that rising wealth inequality is actually bad for the economy, just hunches about how inequality should be bad for the economy based on logical fallacies, anecdotal evidence, or wishful thinking. I implore the liberals and Ron Paul retards to give me one shred of economic data or one peer reviewed case study that shows how wealth inequality in America caused 'xyz bad event' to occur. I don't mean austerity protests or riots, I mean actual economic data such as weak consumer spending or S&P 500 profits falling that can be specifically attributed to wealth inequality. Good luck.

How about 2008? Didn't wealth disparity play a factor in the crash? The opposite, actually. When mainstreet is feeling too rich, it usually means it's time to sell. As housing prices rose in the first half of the the 2000's, millions of Americans were able to obtain easy credit for mortgages they otherwise couldn't afford. In other words, average Americans felt MORE prosperous before the economy hit the skids because of the wealth effect of rising home prices. In the late 90's we saw a similar wealth effect for stocks, and then the market proceeded to fall 50%. But what about financial contagion, excess, and leverage? Contrary to popular belief the contagion from the implosion of the banking and housing sectors was only minimal. Large cap technology companies, exporters, and retailers were only hurt modestly before rapidly recovering. The S&P retail spider, for example, is at historic highs. The QQQ technology 100 ETF has surpassed its 2007 highs. That's why TARP was such a brilliant idea; it infused liquidity to the financial sector so that the other sectors of the economy could resume thriving. With trillions of dollars created in terms of stock market gains and profits & earnings that $700 or so billion (which as all been re-payed) is looking like a drop in the bucket.

2/22/2013 The Daily View: Why Do Stocks Keep Going Up?

Why do I keep being right? Because I look at the totality of the economic data objectivly and draw conclusions on the actual empirical data of how things are, not the way I want them to be. But these libs aren't idiots; they are literate, can read graphs and have some grasp of economics and yet they are always wrong. Here's my theory: too many people are confusing marcoeconomics with sociology. They want to believe there is consumer weakness because in their leftist worldview there should be consumer weakness because consumers are supposedly being taken advantage of by greedy speculatorsm, or simply a self confirmation bias.

I keep reading headlines about everything that's SUPPOSED to be hurting the market and economy such as increased taxes, sequester, and surging gas prices and yet there is almost zero observational evidence in terms of the actual economic & earnings data to support these suppositions. The liberal media & blogs keep front-running the consumer recession that refuses to happen. Maybe the Walmart earnings confirm a little weakness in the US consumer, but this is easily compensated by the booming exports and B2B growth.

The DJIA and S&P 500 have a tendency for rebounding quickly from small losses versus most individual stocks which sometimes take weeks or months to recover from selloffs. For example, Tesla (TSLA) fell 10% yesterday. It will quite a long time before it's able to recover those losses. The DJIA only fell 1% and the losses have already been recovered as of today , almost effortlessly. Obviously, bigger selloffs equals longer recovery times, but why does the market seldom fall much?

One obvious answer is fundamentals such as perpetually low rates,fat profits, rising earnings, nosebleed export growth, a tireless consumer, and all economic news being either better than expected, not a big deal, or priced in.

Another reason why stocks keep going up is because very high liquidity stocks and indexes (such as the DJIA, SPY, QQQ) have a small volume 'clumping factor'. What this means is it is unusual for the volume in these liquid ETFs and indexes to clump, as is commonly observed in more thinly traded individual stocks. According to chart to scalar theory, clumping volume or higher than usual volume results in a higher probability of a stock rising and falling beyond certain price thresholds because higher energy density/magnitude is required to break though the LHS chart support barrier is satisfied. For the DJIA, daily volume fluctuates little and there isn't much clumping, so the probability is high that in the absence of bad news there's won't be much price fluctuation. But you also have the backdrop of bullish economic fundamentals and price action increasing the probability of a buy order versus a sell order.

The stuff in the left hand side of this expression is a unitless LHS scalar and consits of a volume component, an atomic interaction component, and a curvature/geometric component. It is priori information. The RHS has the same component structure of the LHS and in conjunction with solving the lagrangian gives a crude chart of how the stock should trade.

2/20/2013 The Daily View: Washington, Apple, Gold, Profits vs. Revenue, Walmart Emails

It's been nearly two years since I began this blog (on a different url) and have since amassed hundreds of posts most of which aren't on this website but in a cloud archive. Believe it or not, this enormous bloated page only represents a fraction of the total posts. Eventually I'll get around to organizing them in an accessible format.

The fear that Washington will screw up the recovery is irrational because these journalists underestimate the autonomy and resiliency of the US economy and overestimate the power of congress. Thanks to well entrenched policy of de-regulation (repeal of Glass Steagall) and globalization (NAFTA), policy makers have much less influence over the economy than they did decades earlier. Just undoing a small part of the Bush tax cuts took three years. The fed and the treasury has supplanted much of the role of Congress in influencing the economy. Unless there's a real crisis (not one manufactured by the liberal media) then Congress will act with expediency, but otherwise don't expect much.

Now that the election is over Obama's true colors are showing as he's made every effort to sabotage the economy by pressing for raising the minimum wage, cutting defense and raising taxes on the most productive of Americans. The good news is that worst is over and the next GDP is expect to be a robust 2% and the 4th quarter one was revised positive.

Apple. Put a stick in it and cover it in caramel. After a brief reprieve Apple is back to affirming Newton's observation that apples do indeed fall. I remember in Dec. 2012 reading about how it was 'tax related' selling or funds booking profits after a large run. Or that Apple was cheap and undervalued. Apparently the tax selling went into overtime as Apple began 2013 with a rotten quarter and by the end of January became the worst performing stock on the S&P 500. Yes, Apple sells tens of millions of units and will continue to do so long into the future, but P&G sells lots of toothpaste, Microsoft lots of software, and GE lots of turbines. Is there much enthusiasm for those companies? Not really. Stocks tend to trade on the enthusiasm for the underlying business model, not valuations. Buying stocks on a low PE ratio is a surefire losing strategy. Wall St. has a predilection towards transformative companies such as Google, Facebook, Ebay (more specifically Paypal) and Amazon that not only have rapid growth, but are deemed key players in the burgeoning 21st century digital economy. The industry of selling pretty looking electronics has a cloudy future; cloud computing, mobile payments, social media, and advertising has, on the other hand, endless unimpeded growth on the horizon.

Looking back, hardware stocks typically have a growth spurt of around 10-15 years before tapering off or collapsing, packaged software (MSFT) is longer and intangible software/internet applications (Google, Safesforce, Amazon) may be even longer, still. Dell had a 15 year run from 1985 to 2000. Compaq, Gateway, and Acer lasted around 12 years; Research in Motion 10 years. Apple is approaching its 13th year on its second run; its first run from 1978 to around 1993 lasted about 15 years.

The question being asked on blogs and financial TV "Can Apple still innovate?" Does it matter? The fact we're asking such a question is bad news for Apple because if there's one thing Wall St. hates-even more than regulation and taxes- it's forced innovation. Wall St. looks favorably upon innovation, if the company can choose to innovate at its own leisurely pace versus 'forced innovation', which is where Apple is at now. Competition and changing consumer sentiment is forcing Apple to frantically cut prices, introduce lower margin models, and new categories of products in an effort to be relevant. It's too late now. An iWatch or iTV won't be enough to reverse Apple's murky fortunes. Neither will smaller tablets, improved map software, or cheaper phones. Look at LinkedIn, Google, and Facebook. Those sites haven't changed much in the years, except for incremental improvements for usability. Google and Facebook aren't slashing their ad rates or redoing the layout, as Yahoo has been forced to do many times. Best Buy is being forced to innovate against show-rooming. Wall St.'s perfect company is a black box that perpetually prints money, only needs occasional polishing, and has no competing boxes.

Gold? Buy the dip. Central banks can't get enough of this stuff. Not only gold but buy the dip in Brent crude; however avoid WTI crude. One of the pillars of dyseconomics is that there is an implacable demand for all asset classes by foreign institutions due to rapid growth of an emergent upper and middle class. That includes treasuries, junk bonds, munis, REITS.

As a caveat gold probably isn't as good of an investment as RBOB gasoline (UGA), REITS, high yield munis, Brent crude (BNO) or individual stocks like Amazon or Google.

Profits vs. Revenue. In much of the business world, revenue trumps profits. It gives the liberals on blogs like businessinsider false hope that falling profits will be the death knell for stocks when it's falling revenue combined with falling capex expenditures that is the real concern, but gets much less coverage. That's why Amazon.com, for example, can rally after reporting low or negative profits because they are constantly reinvesting profits into rapidly growing revenue producing outlays. As soon as they release the gas pedal on these infrastructure re-investments profit margins will explode, and Wall St. knows this. Profit margins tend to be much more volatile than underlying revenue and can fluctuate on various seasonal and economic factors.

From http://www.princetoncapitalllc.com/better-valuation-from-revenue

The results show that the increase in revenue has a much greater positive effect on the valuation of a business for sale then the negative effect from loss of profit and profit margin. The revenue multiple increased by 83% from the lowest category to the highest....

What does this mean to my business? When making decisions about a new product, service or growth strategy, you should value increased revenues over decreased profit margins...

Let's turn to Dr. Google to see how well liberal predictions for falling profit margins have held up (You can do this for anything. It's hilarious that some of these people are paid to be wrong all the time)

Walmart emails. For the sake of this blog post I'll give the liberals the benefit of the doubt and assume that not only do these emails exist but that they have some negative premonitions about the consumer in them. I'm not losing sleep over these emails and neither is Wall St. which promptly shrugged it off by recovering all its earlier losses on Friday and then rallying an additional half a percent to new five-year highs on Tuesday. Inductive reasoning, or extrapolating future failure on past events has lead to financial ruin for many. The hype is just another example of the failure and crisis obsessed liberals on blogs front-running the nonexistent, but always eminent demise of the consumer, the same consumer that was supposed to succumb to debt, falling wages, and pain at the pump. They take un-falsifiable, anecdotal 'evidence' and hackneyed 'theories' and paste it into their looping narrative of impending economic collapse and proletariat revolution. Failure is the opiate of the liberal masses. Thanks to Obama we had our first negative GDP reading in 16 quarters which was met with elation on liberal strongholds such as Huffingtonpost, New York Times, Businessinsider, Zerohedge and Daily Kos.

Here's what will happen: retail stocks will report yet another quarter of blowout earnings, stocks will keep going up, and the email will serve as an unheeded reminder that reality does, in fact, prevail over wishful thinking.

2/19/2013 The Daily View: Jobs, Congress, Immigration, Higher Ed Bubble, Tesla, Pain at the Pump

The great American job machine stalled out in 2007 but that doesn't mean the economy isn't thriving, because we're still in a Goldilocks economy of tame inflation, blowout earnings, surging stocks, and zero deflation. The strength of the US economy is in intellectual property in the form digital exports, business to business based commerce, mobile/digital payments, web 2.0, social networking, and cloud computing. Job creation has been pushed to the periphery to make way for bigger profits and more productivity and stocks going up all the time. The left says there's poor demand due to inflation lagging wages and supposed weak economy. This is wrong. Thanks to the BRIC boom there are billions of new consumers that a decade a ago didn't exist. Standard & Poor's estimates that 46% of revenue for S&P 500 constituents came from abroad in 2010, and that percentage will only keep growing. We need wealth creation from the top down, instead of bottom-up liberalism. If main street is being left behind, too bad. Not my problem. I want more stocks going up, I want more buy all dips. I want to believe that the free market is the best path to prosperity. The problem with the labor market is not a mismatch of skills or a dearth of job openings, rather wages are too high. The prescription for the US economy is more productivity and lower wages.

As of Tuesday, according to Thomson Reuters, 70 percent of the 353 companies to report earnings beat expectations, slightly better than the 65 percent average in the last four quarters and well above the long-term average of 62 percent. This is the highest in two years, but the left still insists the economy is weak, their shrill cries for crisis and recession still ignored since 2009.

According the bond market there's no need for congress to pass a budget. I agree with Krugman that the US is not Greece and that the spending is sustainable, but we disagree on how the money should be allocated. Spending is not the problem; the problem is liberalism.The problem is consumers hoarding money instead spending as much as possible and protectionist policy that shuns immigration and free market capitalism. Here's my 2013 fiscal compromise:

-cut entitlements

-increase income taxes on those earning less than $200k a year

-eliminate the earned income tax credit

-increase defense

-incentives for outsourcing

-guest worker program and open borders policy

That way we cut the deficit , increase revenue, and keep America safe while promoting pro-growth policy.

We need more immigrants to do the work libs are too lazy, indignant, or unskilled to do. Lazy liberals want all the social programs to themselves while contributing nothing to society but a constant drone of negativity. Not only do 'illegal' immigrants consume a greater percentage for each dollar earned than legal citizens, but they pay into social security with no hope of being applicable to redeem it. Furthermore, legal labor is slow, expensive, and over- regulated.

For years the left has been predicting a bursting of the nonexistent 'college tuition bubble', and they keep being wrong. Higher education is borne out of necessity due to increasingly fickle employers, competitive job market, and demand for technological skills.

Look at this screenshot of failed predictions dating back three years ago. Since 2009 Liberals and paultards have predicted zero of the last dozen bubbles/crisis. They keep being wrong, and god bless them for trying. It makes great entertainment mocking them.

The New York Times vs Tesla debacle pits the curmudgeon reviewer and the antiquated leftist rag against a capitalism success story. This is a smear campaign by the failure & crisis obsessed left. They did this to Facebook before and after the IPO, Goldman in 2009, JP Morgan with the whale trade, Mitt's campaign after the 47% video, Wholefoods after the CEO questioned global warming, and Chick-fil-A for being anti-gay. I post this simple question to Mr. Blodget or anyone else; 'How many times have you ever been stranded because you ran out of gas?' I thought so. It seldom happens unless you are careless and completely ignore the fuel indicators. The people buying these cars are using them for short distances in urban/suburban areas, not 200-1000 mile road trips. I imagine if they are rich enough to afford one, they are competent enough not to get stranded, and can easily summon help if they do.

I still think pain at the pump is funny. It's funny how ppl have to pay more to fill up the tank to get to work. (My solution: work at home) It's funny reading rants on leftist blogs directed against speculators and Bernanke for manipulating prices, when there's not only nothing they can do about it, but that pain at pump is good for the economy which could explain the apathy by congress to do anything about it. If prices won't go lower then liberals wish that gas prices would hurt the economy- in effect driving down prices, but that refuses to happen either.

In 2011 & 2012 I predicted numerous times that pain at the pump is not only going to get worse, but won't prove to be detrimental to the economy whatsoever. In agreement with my predictions, the S&P 500 retail spider is at historic highs along with the rbob gasoline etf UGA. Much to the frustration of the libs, the consumer has learned to adjust to rising gas prices, although having a demonstrable track record of always being wrong won't stop the liberals on the blogs from continuing to front-run the demise of the consumer.

2/15/2013 The Daily View: How to Land a Good Job

I'm getting tired of all the complaining about job loss and recession. If you can't find a job improve your skill set or work for less pay. In this guide I will show you how to land a good paying job. That's my way on behalf of the Institute of Economic Understanding of 'giving back' to those who have been impacted by the worst supposed recession since the 30's or 70's or whenever.

As we all know, many manufacturing jobs have been outsourced or automated, but there's still hope for job seekers. The service sector (e.g., short order cook, WalMart door greeter, cashier, street sign holder) and high tech (e.g., facebook, apple, google, twitter) are growth industries.

To work in the higher paying tech industries it is recommended that you become technologically literate. If you donít already own a computer, buy one. If you already have a computer make sure it plugged in and has internet and so you can send email.

Then proceed to compose your resume with Microsoft Word or Notepad (make sure your computer has a keyboard before attempting this)

It is advised that your resume include your name, phone number, email address (to show technological proficiency), birthday, height, birth weight, birth height, present weight, hair & eye color, waistline (in an effort to improve efficiency companies are penalizing employees who have heath risk factors such as obesity). The resume should also list your hobbies and talents so that you stand out. For example, list your favorite TV show, travel destinations, movie, sports team, or Looney Toons character. If you have any unique skills (e.g., ability to hold your breath a really long time or extra sensory perception) be sure to list them.

Finally put it on monster.com or Linkedin (LNKD).

Once you've completed these steps you'll have a competitive edge and you should start getting high paying job offers almost immediately (check your email!).

I hope this helps.

2/12/2013 The Daily View: How Wealth is Created in The New Era

In The New Era, wealth is created not through the conventional notion of the American dream like home ownership or small business, but through buying stocks, speculation, and internet infastructure (e.g., web 2.0, cloud servers, social networking, digital payments), or as I like to call Matrix infastructure. Perpetually high unemployment and downward economic mobility is a byproduct of an economy running at its maximal efficiency and potential. It's better to have people constantly on their toes for fear of being fired, so they work harder; anxiety begets productivity, productivity begets more profits. Companies are chewing through employees to keep up with the demands of rapid technological progress in the process creating high structural unemployment but more economic growth, better products, and bigger profits. Infastrutre is neglected as a necessity of diverting dwindling federal funds to more pressing issues like defense. The future is one of massive pain at the pump, roads coated in potholes, traffic jams as far as the eye can see, and thick smog in the horizon. I don't know the fate that awaits the masses of unemployed and marginalized Americans but I do know that stocks will keep going up. I do know that the fed will never raise rates again and that the national debt will keep surging because the debt binge- contrary to the misinformation disseminated by the inflation hawks on Zerohedge and Businessinsider will tell you- is forever sustinable in The New Era.

The 2000-2003 period of economic malaise actually dates back to the mid 90's when corporate profits, having risen steadily since the 80's began to fall and the government ran up a budget surplus.

In the graphs below you can see the inflection point of when surplus/GDP began to rise correlates to the peak of profits as a percentage of GDP, around 1996 or so. The irrational exuberance that Greenspan warned us about was already winding to a close.

In 2000 at the peak of an 18 year bull market, everyone felt rich but the balance sheets of S&P 500 companies, on the other hand, were improverished as profits hit multi-year lows. PE ratios were astronomically high and a combination of the Clinton surplus and high interest rates was choking the economy. By the third quarter of 2001 the economy finally entered a recession, the culmination of five years of insidious economic decline that only became apparent in the final year.

Nowadays, mainstreet feels poor but stocks are surging, PE ratios are anemic, interest rates are forever in neutral, S&P 500 companies are flush with cash and we have a BRIC boom creating billions of new consumers. Paradoxically, when the public sentiment is at its most negative is when it's time to buy stocks. In 2008 we became a nation of crybabies forever preoccupied with debt, the misdeeds of Wall St. and unemployment, but the rest of the world has moved on. Smart people are creating multi-million dollar start-ups overnight, speculators raking in millions with long bets on stocks and commodities, home flippers buying foreclosed propery at deep discounts and renting to desperate cash strapped losers at a high premium.

It's indisputable I have been right about everything economics and finance related since 2011. Not only am I an expert, but I have a intuitive grasp of how things work by making connection to things that may not be obvious or forging new connections to create theories that may initially seem preposterous, but agree with the actual empirical data. In 2011 I predicted that rising gas and oil prices would not hurt the economy and lo and behold consumers have learned to adjust to higher prices not by cutting back discretionary spending, but by simply decreasing their personal savings rate and taking on more debt. This is good for the economy to force people to spend. According to dyseconomics all asset classes are positively correlated because of enormous inflows of global liquidity that a decade ago didn't exist, meaning that you can have stocks, treasuries, munis, junk bonds, and commodities all rally together. Of course, this won't happen in tandem but if you plot each asset class since 2009 you will find that they have all made substantial gains. The smallest hiccup from Europe will send treasuries surging, but stocks will fall a little. Then when stocks get overheated treasuries will fall, but not that much. Then oil will rally inexplicably, and one need not wait very long for the usual liberals to blame speculators. Junk bonds and munius are impervious to everything, having long ago defamed bears like Meredith Whitney and Bill Gross.

I also predicted in 2011 that the debt ceiling and in 2012 the fiscal cliff and sequestration would have zero negative long term effect on equities or be inflationary, and with the market making new highs every day my personal reputation for being right to a fault has only been cemented.

Stockcreeper has merged into the Institute of Economic Understanding, a non-profit organization committed to making macroeconomics accurate and accessible. We believe in the dyseconomics interpretation of macroeconomics and The New Era. The Institute consits of three divisions; macroeconomics and futures studies, econometrics, and archives.

There is a growing effort to censor our message. They delete our blogs and posts but everything from as far back as 2011 (including html templates, blog posts, and individual posts) is stored in archives so they can never derive the full satisfaction of expunging our ideas.

The Institute of Economic Understanding is the only organization only one of a handful of websites that accurately and truthfully interprets macroeconomics.

Today's Economic Wrap-Up: Stocks surge, libs lose.

Media-generated Spain inflation scandal. Verdict: not a big deal. Ignore it and buy the dips.

Fiscal slowdown: Non existent as I predicted in 2012 it would be. No one on Wall st. is losing sleep over debt or the overblown fiscal slowdown. Google, IBM, Amazon, Facebook, Twitter are thriving, regardless of what stench is emanating of of Washington.

The 47% of this country wants the economy to contract and for America to be less safe from terror. Wall St. shrugged off that negative GDP, much to the chagrin of the left who's initial elation over the bad GDP number turned to dread as the market pushed above 14000 the next day. I know how economics and options pricing works. I know how stocks work. What the left doesn't yet realize is that the US economy and stock market is thriving in spite of them, not because of Obutthole and that wealth creation is unstoppable.

Any problem, no matter how trivial, is amplified into a crisis in order to push a wealth spreading agenda to 'fix' the non-existent crisis. The libs on news sites like Zerohedge, New York Times, Huffingtonpost, and Businessinsider seek crisis and recession to bring the world down to their level. The fed is creating prosperity in the form of this huge bull market and then you have the liberals on the blogs always criticizing, using the rich as a scapegoat for their problems.

My question is: when did America become such a nation of crybabies? When did failure, or more specifically the wanting of failure, become the new national past time? Why can't we just accept that everyhting is OK, there ar no hidden risks, no tail risk, no problems, no crisis, no double dip, no inflation, no deflation.

2/5/2013 Pricing March 15th BlackRock, Inc. (BLK) Options

From part of the paper about pricing options:

http://en.wikipedia.org/wiki/User:Stockequation/sandbox#Pricing_Options

I'm going to price BLK puts and calls using Chart to Scalar. BLK rose from 190 to 239 (2/5/2013 closing price) in roughly 50 trading days. The March 15th Call/Put expires in 28 trading days.

It has an average daily volume of 7.7*10^5 (yahoo finance) And an average order size of a_v=2*10^3 to 3*10^3 upon looking at the one day yahoo finance chart

The mast extends to 267

show steps

The standard deviation is roughly 11.37

show steps

786000 is the constant q or v_g/(p_3-p_i)

The truncation factor is tiny and can be ignored

Let's price our $240 March 15th call

show steps

Truncated call: $3.84

show steps

non-truncated call: $4.06 which agrees with the yahoo finance quotes

240.00 BLK130316C00240000 4.25 1.16 3.90 4.20 13 254

increasing the a_v to 3*10^3 increases the call it to 4.5

The non-truncated $250 call is $1.01; truncated $.91

show steps

Versus yahoo finance which has a bid/ask of $.8 x $1.0

The short term put options seem way overpriced

Chart to scalar gives $1.39

show steps

Versus yahoo Finance quotes of 2.50X2.85 bid/ask

Summary: Downside protection is too expensive because of increased possibility of bad news from Europe?

2/4/2013

Because stocks are falling today it's time to price some short options and a put option.

Example 1: Facebook (FB), Feb 15th $28 call

Facebook has fallen from 32 to 28 in roughly seven trading days. It has an average daily volume of 7*10^7 shares. The Feb 15th expires in 9 trading days. In 9 days that is 9*7*10^8 volume.

Solving the equlibrium equation shows the mast extends to $33 as the upper limit.

http://www.wolframalpha.com/input/?i=%2814*7*10%5E7%29%2F%28%288%29%282%2Bln%28x%2F2 8%29%29%29%3D%287*9*10%5E7%29%2F%282*%289%2 F14%29*8%2B%28x-28%29*%28ln%28x%2F28%29%29%29

The average order size is around 1*10^5 to 2*10^5 by looking at the one-day yahoo finance chart for FB.

For a_v=2*10^5, sigma_p=2.3

http://www.wolframalpha.com/input/?i=%28%289*7*10%5E7*2*10%5E5%29%5E%281%2F4%29*%288*28.20*122500000 %2B%289*7*10%5E7*2*10%5E5%29%5E%2 81%2F2%29%29%5E%281%2F2%29%2B%289*7*10%5E7*2*10%5E5%29%5E%2 81%2F2%29%29%2F%282*122500000%29>

For a_v=10^5, sigma_p=1.9

The truncation factor is small

http://www.wolframalpha.com/input/?i=1%2F%28erf%285% 2F%282%5E.5*2.3%29%29%29

The truncated call is worth $.99 for a_v=2*10^5

http://www.wolframalpha.com/input/?i=integrate+from+28+to+33+%28103%2F100%29%28x -28%29*e%5E%28-%28-28.3%2Bx%29%5E2%2F%282*2.3%5E2%29%29%2F%282.3+sqrt%282+*3.14%29%29

Non-truncated call: $1.11 for a_v=2*10^5

http://www.wolframalpha.com/input/?i=integrate+from+28+to+infinity+%28x-28%29*e%5E%28-%28-28.3%2Bx%2 9%5E2%2F%282*2.3%5E2%29%29%2F%282.3+sqrt%282+*3.14%29%29

The non-truncated call is worth $0.92 when a_v =1*10^5

For comparison, Yahoo Finance gives:

0.96 0.93 0.94 http://finance.yahoo.com/q?s=FB130216C00028000

The facebook $28 call with a March 15th expiration is a good deal because chart to scalar overprices it when a_v is increased to 2*10^5.

2/1/2013 Pricing Options with Chart to Scalar

With Chart to Scalar, the official option pricing algo of The New Era, we price options not with brownian motion and log-normal drift but by converting stock charts into simple lines and triangles that represent resistance and support forces. These shapes (and more complicated ones such as convex and concave curves) result from the interection of buy and sell orders in a trading space.

In this example Chart to Scalar will be used to price SPY March 15th 2013 150 strike options with the following assumptions: 0% risk-free interest and no extra buy orders. Data is as of the close of 1/31/2013.

By cursory observation SPY has risen from 135 to 150 in a 2.5 month period (about 50 trading days) and has a daily volume of 1.4*10^8 shares. The call option has a strike of 150 and expires in 1.5 months or around 30 trading days.

Because there is no resistance triangle we have to invent one. The support trianlge is the reflection which is already established.

Our main variables:

v_g=50*1.4*10^8

v_r=30*1.4*10^8

p_3=165 (the mast of the conceived resistance triangle)

p_1=150 (current price)

x_2-x_1=1.5 (months)

x_1-x_0=2.5 (months)

a_v=5*10^5 (can range between 10^5 to 10^6. It's a very heavily traded ETF)

q=v_g/(p_3-p_1)=4.67*10^8

Plugging these into the equilibrium equation and solving (I have linked the steps to wolfram alpha to make it easier to follow along)

http://www.wolframalpha.com/input/?i=0%3D4.67*10%5E8%2F%282%2Bln%28x%2F150%29%29-%282.5*30*1.4*10%5E8%29%2F%282*1.5*15%2B%28x-150%29*2.5*%28ln%28x%2F150%29%29%29

Wolfram research can apparently plot it but refuses to solve it, so 156 is the closest approximation.

P_max=156 (the resistance triangle)

p_min=144 (the support triangle, which is a simple reflection about y=150)

Now use the standard deviation quadratic approximation formula

http://www.wolframalpha.com/input/?i=%28%2830*1.4*10%5E8*5*10%5E5%29%5E%281%2F4%29*%288*150*4.67* 10%5E8%2B%2830*1.4*10%5E8*5*10%5E5%29%5E%281%2F2%29 %29%5E%281%2F2%29%2B%2830*1.4*10%5E8*5*10%5E5%29%5E%281%2F2%29%29%2F%282*4.67*10%5E8%29

sigma_p=5.48

mu_p=150

Calculate the truncation factor:

http://www.wolframalpha.com/input/?i=%282*erf%286%2F%282%5E.5*5.48%29%29%29

N_o=1.45

Integrating the probability density function

http://www.wolframalpha.com/input/?i=intragrate+from+150+to+156+%28x-150%29*e%5E%28-%28-150%2Bx%29%5E2%2F%282*5.48%5E2%29%29%2F%285.48+sqrt%282+*3.14%29%29

N_1-N_2=.99

Put it together to calculate the call option

http://www.wolframalpha.com/input/?i=%282%2F1.45%29%28.99%29

C=$1.37 for a 1.5 month expiration (March. 15th 2013) SPY 150 Call

If a_v=10^5 then C_150=1.2 for a lower bound

If a_v=10^6 then C_150=1.4

These options are very cheap compared to the 'official' ones quoted on yahoo finance or morningstar.com, but that's because the truncated pricing formula is being used.

Today on 2/1/2013 SPY closed at 151.24.

The 151 call March 15th according to the un-restricted option pricing formula is 1.32

http://www.wolframalpha.com/input/?i=intragrate+from+151+to+infinity+%28x-151%29*e%5E%28-%28-151.24%2Bx%29%5E2%2F%282*5.5%5E2%29%29%2F%285.5+sqrt%282+*3.14%29%29

Versus morningstar.com official quotes:

151.00 2.29 2.32 2.34 (bid/current/ask)

Going down the call table the formula outputs:

C_152 = 1.84

C_153 = 1.43

C_154 = 1.09

Versus morningstar.com

152.00 1.75 1.78 1.80

153.00 1.30 1.32 1.33

154.00 0.88 0.92 0.95

The 'official' SPY call options are probably overpriced, but chart to scalar is making the asumption that buy and sell orders have equal probability and the the trading volume is evenly distributed about x_2-x_1. If a stock is in an persistent uptrend then it is safe to assume there is a slight buy order bias which would be reflected in higher values for sigma_p and mu_p.

Perhaps selling SPY March 15th calls with a 156 or 157 strike maybe be a good strategy because that is the upper bound of the truncated price range.

2/1/2013

Da da da dum another post. woo hooooooo markets keep going up for all the reasons I've given in my earlier posts. The jobs report coudn't have been more bullish: an uptick in unemployemnt will keep the fed on the gas pedal but the increase in new jobs will create the impression that the economy is in recovery. Hopefully we will get to 8.5% unemployment and dow 15000. We need more productivity, exports, consumer spending and fewer jobs. I want more buy all dips. I want more stocks going up. In America we may not create many jobs but we also have the best performing stock market in the world and all the biggest social networking sites. We have google, apple, and amazon. We have Fox News and CNBC. We have the most productive workers in the world. We have a congress that is committed to pro-growth and less regulation.

1/28/2013

Here we go again. Another huge rally for the market, another post on stockreeper, more crap links posted on businessinsider. These perts are making it a stuggle, but progress is what is done. When it's finished it is beneath you and you can move on. The goal is completion, to take these ideas and put them in written form right now. Like a sedimentary rock each layer of strata is a task or an idea, and each new idea buids upon a previous one until you have a finished product.

Today's essay: Things That Don't Matter (with regard to stocks)

Markets are surging despite an awful consumer confidence number. What gives? I'll explain. Investors are bombarded with economic data, but 99% of it is of zero predictive value with regard to quities and should be ignored. The good news is most retail investors do ignore it, but it's usually the bloggers that ruminate over these trivialities. They get stuck in the minutiae of the economy while missing the bigger picture.

Consumer confidence doesnt matter becuase (news flash) un-confident, consumers consume as much a optimistic ones. But there is an upshot- poor consumer confidence, which is positively correlated with a poor labor market results in consumers being more productive at work for fear of being fired. In this sense, poor consumer confidence is actually good for the economy because spending is unchanged but productivity goes up.

Did you hear about the 1994 scare? I did, and laughed it off. The risk of a repeat of the 1994 bond market mini-crash is non-existent. The libs have predicted ninety of the last zero crisis. Since 2009 they predicted hyperinflation, deflation, bank crisis relapse, bond market collapse, double dip recession, S&P 500 profits contraction, bear market, Greece default, Eurozone collapse, consumer spending contraction, de-leveraging, bursting of the education bubble - all wrong. Not a single prediction came to fruition. The slightest hiccup from Europe will send yields crashing even if the major indexes keep rising along with oil and gas prices. The world is awash with liquidity and unlike the 90's there is an unquenchable demand by foreign governments and institutions for exceptionally low yielding US paper. Dow 15000 and the 10 year treasury yield may finally break 2.5.

Housing starts, housing stops, home prices, new permits, pending home sales, etc. Lumped together as 'housing', none of these matter much. Despite getting a disproportiante amount of news coverage, housing only contributes 2-4% of the US GDP. As far back as 2006 when I began following the economy more closely I can't recall a SINGLE time the market has ever fallen substantially on a poor housing number. I think the worst I can remember is a loss of 50 points on the DJIA on a horrific number, but not more.

Manufacturing surveys: Dallas Fed, Philadelphia Fed, Richmond Fed etc. All of these can be lumped as 'manufacturing', and like housing seldom move the market even when the number is bad. The strengh of the US economy is in intellectual property based exports (movies, software, social networking, cloud), consumer spending, free market capitalism, service sector, and financial services. Manufacturing is only a couple of inches above dirt on the economic totem pole. The most I have seen the market fell on bad manufacturing data is around 50 points.

Beige book. Another non-event.

Consumer credit. 95% of the time better than expected. Waiting for that consumer deleveraging? Not gonna happen, sorry. American consumers have a propensity for comsumtion and credit unmatched in the world.

Durable goods is another indicator worth ignoring. This tends to be very volitile and a poor predictor or future stock market returns or economic growth. Released at 5:30 it seldom moves the market much even when the number misses badly, as it often does.

Weekly jobless claims. Unlike other indicators this has the potential to move the market, but has a positive bias because it's impossible for the number to be truly 'bad'. For example, if it comes in weak then it increases the odds of more fed easing. If it comes in strong then it's a sign of economic strength. Either way, a win for the markets.