I came across this story, which went viral MIT Predicted in 1972 That Society Will Collapse This Century. New Research Shows We’re on Schedule.

If I had a dollar for every forecast of how “X is supposed to cause Y”…

“Trump winning was supposed to tank the U.S. economy,” according to Paul Krugman

“Trump tariffs were supposed to cause economic crisis”

“We must shutdown small businesses to flatten the curve”

“2008 was supposed to be the end of capitalism, housing market, etc.”

“Global warming was supposed to flood coastlines, rendering hundreds of millions of people homeless”

“Covid was supposed to kill 1-3% of the world population”

The post-Covid economic and stock market boom exceeded even the the most optimistic of forecasts. Individuals who stayed invested made a killing, and the market keeps going up. It pays to be optimistic unless you’re the media, in which doom and gloom means more clicks and ad revenue.

These complex, interconnected system are more resistant to collapse than the media and experts assume. The bigger a system becomes, the more resources will be summoned to protect and ensure its continued existence, which is why if I had to predict, there will be no collapse and the bull market and economic expansion will continue even in spite of all the things that are going wrong. At any point in history, there will always be things that are going wrong somewhere.

To keep the system going, it’s remarkable how much spending has ballooned over the past 13 years, and this is coming from someone who is receptive to MMT. After 911, only the airlines got a bailout, which came to a paltry $15 billion. The 2008 bailouts set a precedent for printing-away problems, which at the time was a monumental undertaking and not without considerable deliberation, yet another $1 trillion for infrastructure (on top of all the trillions for Covid aid) feels like an afterthought, at a whim. We really are in the era of free money. We’re nowhere near the boundary what is possible. The idea is that massive cash infusions, from both the treasury and the fed, can attenuate market volatility and cycles until the underlying problem goes away. The boom-bust cycle has thus since 2009 become a perpetual ‘boom’, with low interest rates and stimulus providing a boost when things get turbulent.

As far as the social sciences are concerned, these experts tend to have a terrible track record at this sort of stuff, whether it’s incorrect calls of a housing market crash, stock market crash, recession, hyperinflation, etc. Economics and finance is one of the few areas in which the experts and the ‘expert consensus’ can be hopefully wrong…you typically do not see this with fields such as physics or math. Not just econ, but also behavior psychology: anywhere from 50-75% of psychological studies don’t replicate. Priming, one of the cornerstone findings of the best-selling Thinking Fast and Slow, failed to replicate. “Five years later, Kahneman’s concerns have been largely confirmed. Major studies in social priming research have failed to replicate and the replicability of results in social psychology is estimated to be only 25% (OSC, 2015)”

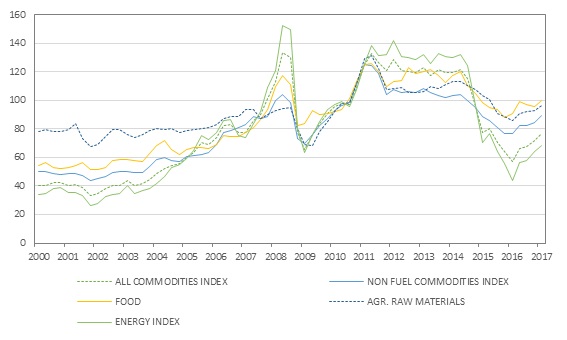

Forecasts of resource depletion and unsustainability also have poor track record, too. In 2007 there were concerns about commodity hyperinflation leading to worldwide shortages. A decade later, prices would make new lows:

‘Expert’ Robert Shill Shiller for years been calling for a stock market and real estate crash based on some useless/obsolete metric. Michael Burry famous for ‘predicting’ and profiting from the 2008 collapse of the housing market, for years has been sounding the alarm of high inflation. Peter Schiff is another one, since 2008 has been predicting the collapse of the US dollar. Mike ‘coke head’ Saylor shepherded his followers to buy bitcoin above $50,000 because of the promise it would change the world. If fool me once, shame on you, fool me twice, shame on me, the enduring popularity of the aforementioned individuals suggests there is considerable shame to go around.

But going back to the MIT forecast, 80 years remain in this century. Looking out that far ahead is impossible for any social science model (economists fail even when trying to look ahead a few years), but it would not surprise me at all if the post-2009 expansion continues interrupted for 3 more more decades based on the interest rate cycle and the favorable spread between inflation and short-term bonds (the idea that near-zero interest rates forces people to invest in riskier assets). And also the tech sector and retail being major drivers of growth too.

I certainly hope you are right. As a devil’s advocate I would point out that during President Wilson’s tenure (when federal tax was introduced) about $755/capita per annum was spent by the US Government (in 2020 dollars). Today, the amount is over $10K for every man woman and child per annum. In Washington, DC, the annual budget is $24K per capita.

A lawyer friend recently told me that over 50% of all law school students are women.

We seem to have entered into a feminist/feminine world of passive victims with no agency (except for hetero white men) and high dependency. Apparently, humans need to believe in something and when they stop believing in a sky god or male ancestors or heroes they revert to worship of an earth goddess by default. You’d have to go back over 7,000 years in European history to find a similar situation.

How all this plays out with corporations time will tell. But, in the epicenter of it all (Washington, DC) they live off of very wealthy NGO donors, special interest group donors like the NAACP, and taxes. There is virtually no enterprise in DC other than restaurants, yoga salons, lawyers, lobbyists and small shops. All major corporations, like Amazon, service government.

Curiously, there seems to be a mini-baby boom amongst the feminists. I have never seen so many strollers in one place. I guess they’re going to flood the zone. All white kids with their moms cheek by jowl with strung out junkies, deranged idiots and petty criminals, where the average 1-bedroom costs $500K. The other group lives in public housing and ex-felon halfway dorms, usually within a few blocks.

Turchin is not the only one who is worried. Eric H. Cline, who teaches at the George Washington University, argued in “1177 B.C.: The Year Civilization Collapsed” that Late Bronze Age societies across Europe and western Asia crumbled under a concatenation of stresses, including natural disasters — earthquakes and drought — famine, political strife, mass migration and the closure of trade routes. On their own, none of those factors would have been capable of causing such widespread disintegration, but together they formed a “perfect storm” capable of toppling multiple societies all at once. Today, Cline says, “we have almost all the same symptoms that were there in the Bronze Age, but we’ve got one more”: pandemic. Collapse “really is a matter of when,” he told me, “and I’m concerned that this may be the time.” In “The Collapse of Complex Societies,” Tainter makes a point that echoes the concern that Patricia McAnany raised. “The world today is full,” Tainter writes. Complex societies occupy every inhabitable region of the planet. There is no escaping. This also means, he writes, that collapse, “if and when it comes again, will this time be global.” Our fates are interlinked. “No longer can any individual nation collapse. World civilization will disintegrate as a whole.”